Introduction

A Detached Accessory Dwelling Unit (ADU or DADU for short), often called a backyard cottage, granny flat, or carriage house, is the ultimate way to maximize property value, generate passive income, and provide flexible living space.

Unlike attached units or garage conversions, a detached ADU is a standalone structure built from the ground up, offering superior privacy and design freedom. But what exactly does it take to build one, and what is the true cost?

This comprehensive guide breaks down the financial, regulatory, and logistical steps to successfully complete your detached ADU project, ensuring you turn your backyard into a powerful asset.

I. The Detached ADU Cost Breakdown: Why They Cost More Than Conversions

Detached ADUs typically command a higher initial price tag than some other common ADU types due to critical site work and utility connections. Understanding this upfront will help you budget effectively. But there are major benefits for choosing a detached ADU. Remember that price isn’t the only, and shouldn’t always be the most important, deciding factor for what type of ADU to pursue.

The current national cost range for a newly built detached ADU generally falls between $250 to $500+ per square foot, but your final number depends heavily on location, design complexity, and material finishes.

As an aside, I mention cost per square foot here, but I personally find that to be a terrible way to estimate the true cost of an ADU. Smaller ADUs have a much higher cost per square foot than larger ones as there is an economy of scale. Small ADUs still need all the expensive parts like kitchens, bathrooms, mechanical, electrical, and plumbing systems. A better estimated price range would be to assume most ADUs will fall in the $200,000 to $500,000 range depending on size, complexity of design, quality of materials, and site conditions. Size is only one aspect of determining the final price.

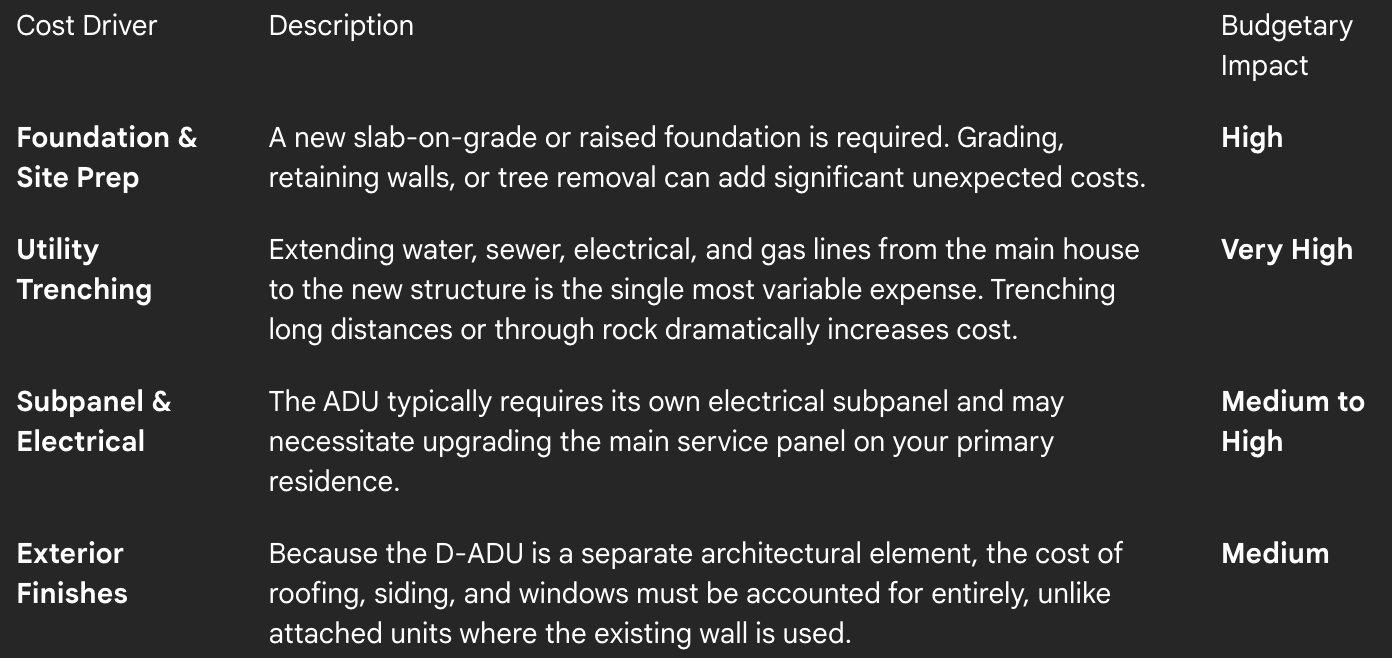

Unique Cost Drivers for Detached ADU Construction

To accurately budget your project, pay special attention to these expenses, which are unique to detached structures:

FURTHER READING: For a deep dive into financing your ADU, get our Ebook:

How to Finance Your ADU: A Guide to Loans, HELOCs & Creative Financing.

II. Detached ADU Design & Zoning Requirements

The single biggest differentiator between a successful ADU investment and a stalled project is your command of zoning requirements and their strategic application to design. It’s not simply about checking boxes; it’s about viewing local ordinances as the design DNA of your detached unit. A design firm that’s an expert in ADUs understands that setbacks, height restrictions, and lot coverage rules are not barriers—they are the constraints within which they engineer maximum value, and rentable space. By mastering these parameters early, the design team ensures the design is not just compliant, but is an elegant solution that anticipates permitting challenges, ultimately safeguarding your budget and timeline from the outset. It is also recommended that homeowners read their local zoning codes and ADU regulations so they know what is allowed and what to expect. This can help you pick the best design if you are going with a pre-designed ADU plan, or have better conversations with your custom design team.

Zoning: Setbacks, Lot Coverage, and Height Restrictions

1. Setbacks: Defining the Location

Setbacks determine how close your Detached ADU (D-ADU) can be built to the property lines. They are a critical factor because they dictate the location and also may impact the maximum width and length of your structure.

State vs. Local Rules: While many state laws (like in California) mandate minimum setbacks as little as 4 feet from the side and rear property lines, local jurisdictions may impose stricter rules or looser ones. These local overlays often relate to fire safety, utility access, or neighborhood design review, and you must adhere to the strictest applicable rule.

Strategic Placement: Understanding corner lot rules, front yard exceptions, and the necessity of fire access paths is essential for maximizing the usable space allowed by the setbacks.

2. Lot Coverage: Managing Site Density

Maximum lot coverage regulates the total percentage of your lot area that can be covered by all structures, including the primary home, garage, and the new D-ADU. This is a common bottleneck for properties with small yards or large main houses. Often local regulations will limit the footprint of structures rather than the full square footage of built area, so make sure you check your zoning code to see what is allowed or contact an experienced ADU designer in your area.

Calculating Density: For example, if your lot is 5,000 square feet and the maximum coverage is 40%, only 2,000 square feet of structures are allowed. If your house already uses 1,800 square feet, your ADU is limited to a mere 200 square feet.

The Exemption Angle: If your lot coverage is limiting what you can build, knowledgeable designers will look for local exemptions, such as rules that exclude features like permeable patios, trellises, or specific foundation types from the lot coverage calculation, allowing you to maximize the buildable footprint of the ADU itself.

3. Height Restrictions: Unlocking Multi-Story Design

Height limits are imposed to ensure the ADU remains subordinate in scale to the primary home and to mitigate concerns about shadowing or excessive bulk from neighbors. Most jurisdictions restrict D-ADU height, often between 16 and 25 feet.

The Two-Story Challenge: This restriction is vital if you plan for a two-story design. If the local limit is 20 feet, an architect must strategically choose roof types (low-slope vs. peaked) and foundation methods (slab vs. raised) to gain enough vertical space for two full, code-compliant, and highly rentable floors. We have even been creative to get two story structures under the height limit but submerging the ground level of an ADU a few feed below the grade of a yard. These types of creative solutions are why hiring an experienced company like Modern ADU Plans can lead to the best option for your situation.

Engineering Value: When height is constrained (e.g., 16 feet), the design must shift to a single story or a structure with attic-like space, proving that the D-ADU's design must be calibrated to the specific inch of the local height code to maximize your investment return.

Design Considerations for Modern D-ADUs

The detached nature allows for maximum design flexibility and architectural excellence for both the exterior look and feel and the interior layout and function. Focus on these elements when choosing your plans or discussing a custom design:

Privacy and Separation: Orient windows and outdoor spaces (like decks or patios) away from the primary residence and neighboring properties to maximize tenant comfort and value.

Making a Small Home Feel Larger: use views, access to narture, sliding doors, open layouts, and heigh ceilings to make the smaller spaces of an ADU feel larger.

Curb Appeal: The D-ADU should complement the main house but embrace a modern, efficient design. You don’t want it to look like a fake imitation of a historic style. The ADU design should reflect the time it was built. Focus on large windows, sustainable materials, smart siding, and clean rooflines. Look for design elements that can enhance the feel of the ADU through trellises, wood screens, planters, and other design elements that make the home feel welcoming.

Accessibility: Consider future use. Incorporating zero-step entryways and barrier-free bathroom layouts significantly increases the value and flexibility of the unit for aging-in-place. Whether you are building this now for an aging family member, or you plan to move into the ADU in the future when you are getting older, thinking about accessibility during the design can make your ADU ready for any future use. Plus it could demand higher rent, and be worth more as an investment.

III. Step-by-Step Construction: The Detached ADU Process

The process for building a Detached ADU (D-ADU) is structurally akin to building a small custom home, demanding the same professional rigor, design documents, engineering precision, and schedule discipline. Unlike minor renovations, a D-ADU rbegins with ground-up site work—a phase that is frequently underestimated. Mastering the sequence of these steps is essential, as permits, inspections, and contractor coordination depend on adherence to this order. Knowing the sequence not only helps you manage contractors and timelines but also empowers you to anticipate critical milestones like utility connections and final Certificate of Occupancy, transforming you from a passive homeowner into an informed project manager.

Phase 1: Pre-Construction & Site Preparation

Demolition & Site Clearing: Clearing the area, removing existing sheds, and performing any necessary tree removal.

Permitting: Final sign-off on construction documents.

Excavation & Foundation: Digging utility trenches and pouring the foundation (a critical first step that must pass inspection).

Phase 2: Shell Construction (Framing and Weatherproofing)

Framing: Erecting the walls, floor, and roof structure.

Rough-Ins: Installing electrical wiring, plumbing pipes, and HVAC ductwork before the drywall goes up. This includes running the trenches to the main house.

Exterior Finishes: Installing roofing, windows, exterior siding, and weather barriers to make the structure water-tight.

Phase 3: Interior Finishes & Final Inspection

Insulation & Drywall: Completing the walls and ceiling.

Interior Finishes: Installing flooring, cabinetry, interior doors, and plumbing/lighting fixtures.

Landscaping & Connections: Final grading, connecting utilities, and completing any required fire access paths.

Final Inspection: Receiving the Certificate of Occupancy (COO), which allows the unit to be legally rented or lived in.

GET STARTED: Ready to find your build partner? Read our guide: Your Guide to Hiring a General Contractor for Your ADU Project.

IV. The Best Detached ADU Plans for Any Backyard

Choosing a pre-designed plan dramatically cuts down on the design timeline and cost compared to a fully custom build. Our plans are specifically engineered to meet modern code requirements while maximizing living space.

Here are a few of our most popular detached ADU plans, perfect for various needs and lot sizes:

Ready to Realize Your Backyard’s Potential?

Browse our full collection of architect-designed detached ADU plans and find the perfect fit for your property and investment goals.